Checking Your JPA Retirement Status: A Comprehensive Guide

Retirement planning is a crucial aspect of financial security, especially for public servants in Malaysia. The Public Services Department of Malaysia (JPA) plays a significant role in managing retirement benefits. Understanding how to verify your retirement status with JPA is essential for a smooth transition into this new phase of life. This comprehensive guide will walk you through the process of checking your JPA retirement status, providing valuable insights and practical advice.

For Malaysian public servants, "semakan status persaraan JPA," which translates to "JPA retirement status check," is a critical process. It allows individuals to stay informed about their retirement benefits and plan accordingly. Knowing your projected retirement date, estimated gratuity, and pension amount can help you make informed financial decisions and prepare for a comfortable retirement.

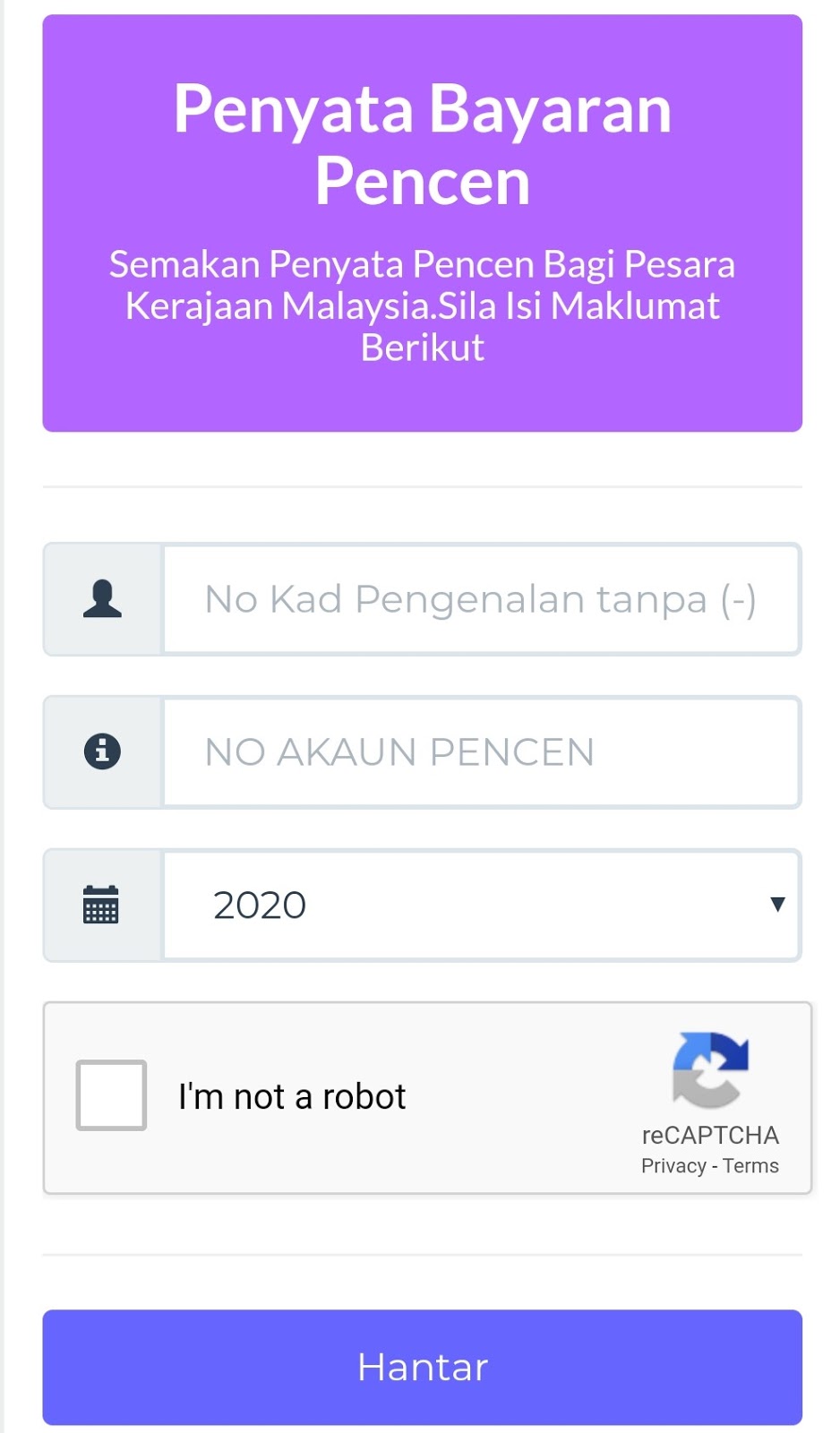

The JPA's online portal has made checking retirement status much more accessible. Previously, obtaining this information might have involved manual processes and direct inquiries. Now, with the digitalization of services, public servants can conveniently access their retirement information online, saving time and effort. This online system embodies the government's commitment to providing efficient and transparent services to its employees.

A key concern for many nearing retirement is the accuracy of their recorded service duration and other related information. The JPA retirement status check addresses this concern by providing individuals with an official record. Verifying this information ensures that calculations for benefits like gratuity and pension are based on accurate data, preventing potential discrepancies later on. This allows for better financial planning and peace of mind.

The importance of periodically reviewing your JPA retirement status cannot be overstated. Regular checks enable you to stay informed of any updates or changes to regulations that might impact your retirement benefits. This proactive approach empowers individuals to address any inconsistencies or discrepancies early on, ensuring a seamless retirement process.

One of the primary benefits of using the JPA retirement status check is the ability to plan your finances effectively. Knowing your projected retirement income allows you to adjust your savings and investment strategies accordingly. For example, you can determine if you need to supplement your pension with other income sources or adjust your lifestyle to match your projected retirement income.

Another advantage is the convenience and accessibility of the online platform. Instead of making physical visits to JPA offices, individuals can access their retirement information anytime, anywhere with an internet connection. This saves valuable time and resources.

Thirdly, the system promotes transparency and accountability. By providing clear and readily available information, the JPA fosters trust and confidence among public servants. This transparency allows individuals to understand how their retirement benefits are calculated and ensures fairness in the process.

While specific steps may evolve with system updates, a general approach involves accessing the JPA portal, logging in with your credentials, and navigating to the retirement services section. Once there, you can view your retirement status details.

Frequently asked questions often revolve around login issues, data accuracy, and understanding the presented information. The JPA portal usually provides helpful resources to address these queries. It’s advisable to contact the JPA directly for specific or complex situations.

Advantages and Disadvantages of Online JPA Retirement Status Check

| Advantages | Disadvantages |

|---|---|

| Convenience and Accessibility | Requires Internet Access |

| Time-saving | Potential Technical Issues |

| Transparency | Data Privacy Concerns |

In conclusion, the JPA retirement status check is a vital tool for Malaysian public servants. It empowers them to take control of their financial future by providing easy access to crucial retirement information. Understanding the process and its benefits is crucial for a smooth and secure transition into retirement. By actively engaging with the system, individuals can ensure they are well-prepared for this important life stage. The convenience, transparency, and accessibility of this online system reflect the government's commitment to the well-being of its employees. Take advantage of this resource to plan your retirement effectively and secure your financial future.

Unlocking the shadow world rolemaster guide

Decoding the cost of bowling a deep dive

Wells fargo wire transfer locations and hours