Killing Your Plastic: The Ultimate Guide to Credit Card Termination

Ever feel like your wallet is bulging with unwanted plastic? We're talking credit cards, those seductive rectangles of spending power that can quickly become a burden. Sometimes, breaking up is hard to do, but when it comes to a credit card that's no longer serving you, a clean break is essential. This is where the mighty credit card cancellation letter comes into play. It's your formal declaration of independence from debt, your weapon against unwanted fees, your ticket to financial freedom (or at least, a slightly less cluttered wallet).

So what's the deal with these letters, anyway? They might seem like a relic of a bygone era, a formality in a digital age. But trust us, they're still incredibly relevant. A well-crafted termination letter provides a documented record of your request, protecting you from potential future charges and disputes. Think of it as your official "I'm outta here" message, ensuring a smooth transition and minimizing the risk of lingering financial entanglements.

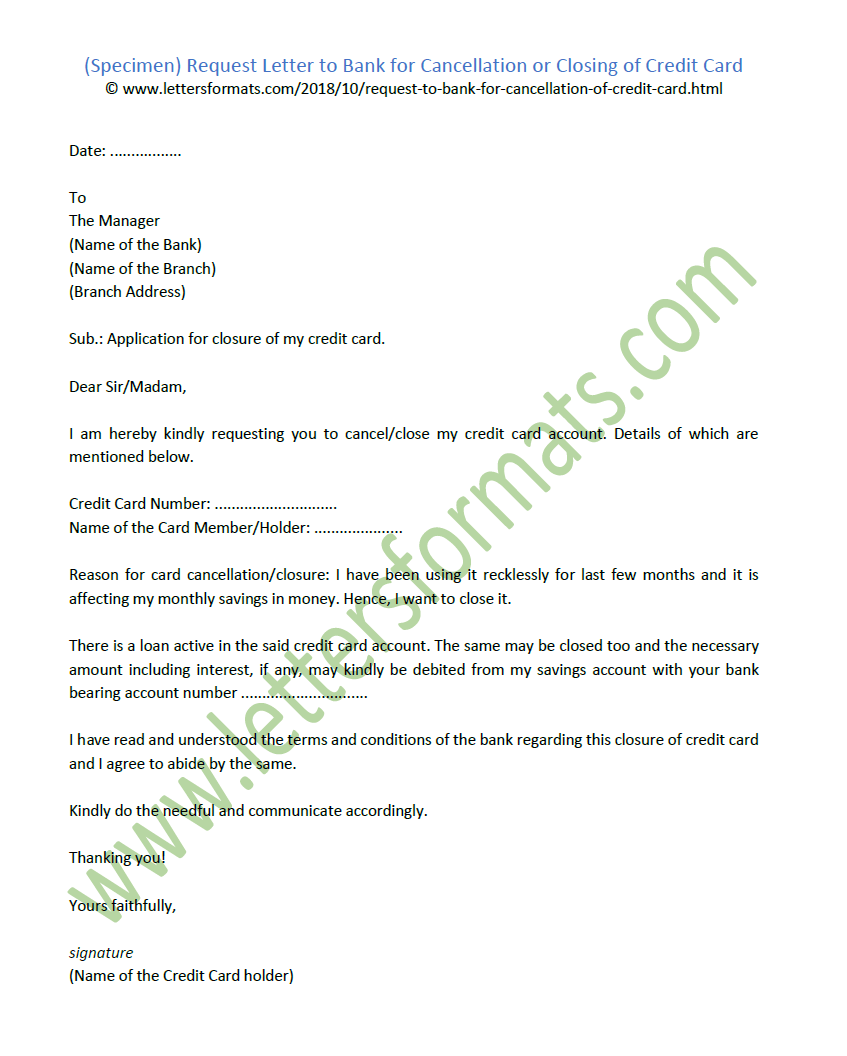

Requesting credit card account closure isn't as simple as tossing the card in a drawer. You need a paper trail, a clear and concise communication that leaves no room for misinterpretation. This is the core function of a credit card closure request document. It formally communicates your intention to sever ties with the card issuer, providing all the necessary details to ensure a clean break. This includes your account number, the date you want the card deactivated, and a request for confirmation of the closure in writing.

While the digital age offers convenient online cancellation options, a formal letter requesting credit card account termination still holds significant weight. It provides undeniable proof of your request, which can be crucial in resolving any future discrepancies or billing issues. Imagine a scenario where you cancel your card online, but the system glitches and your account remains active, accruing fees. With a written letter, you have concrete evidence to support your claim.

The origins of the credit card cancellation letter are intertwined with the history of credit cards themselves. As credit cards became more prevalent, the need for a formal process for terminating these agreements arose. While the methods of communication have evolved, the underlying principle remains the same: a clear, documented request for account closure. This ensures that both the cardholder and the issuer are on the same page, minimizing the potential for confusion and disputes.

A well-written credit card cancellation request typically includes your name, address, account number, the date you want the card closed, and a request for written confirmation. You may also want to specify reasons for cancelling, such as high fees or switching to another card. A simple example would be: "Please close my credit card account, number XXXX-XXXX-XXXX-XXXX, effective immediately. Please confirm the closure in writing to the address above."

Benefits of a Credit Card Cancellation Letter:

1. Proof of Request: Provides tangible evidence of your cancellation request, protecting you against potential future charges.

2. Clarity and Accuracy: Ensures all necessary details are communicated clearly, minimizing the risk of errors or misinterpretations.

3. Dispute Resolution: Serves as a valuable document in case of any future disputes regarding your account closure.

Steps to Cancel a Credit Card:

1. Redeem or transfer any remaining rewards points.

2. Identify recurring charges and update payment information with the new card or bank account.

3. Draft your credit card cancellation letter.

4. Send the letter via certified mail with return receipt requested.

5. Follow up with the credit card company to confirm closure and request a written confirmation.

Advantages and Disadvantages of a Credit Card Cancellation Letter

| Advantages | Disadvantages |

|---|---|

| Provides a paper trail | Can be slower than online cancellation |

| Offers legal protection | Requires more effort |

Best Practices: Send your letter via certified mail, keep a copy for your records, follow up with the issuer to confirm closure, check your credit report to ensure the account is closed, and shred your physical card.

FAQs:

1. What if I don't have the credit card company's address? Check your credit card statement or their website.

2. Can I cancel my card over the phone? Yes, but it’s recommended to follow up with a letter.

3. What happens to my rewards points? Redeem them before cancelling.

4. Will cancelling my card affect my credit score? It can, especially if it increases your credit utilization ratio.

5. How long does it take for a credit card to be cancelled? Typically a few business days.

6. What should I do if I continue to receive bills after cancelling? Contact the credit card company immediately.

7. Can I reopen a cancelled credit card? Sometimes, but it may involve a new application.

8. What if the credit card company doesn't respond to my letter? Follow up with a phone call.

Tips and Tricks: Always keep a copy of your cancellation letter and the confirmation from the issuer. Consider sending your letter via certified mail for proof of delivery.

In conclusion, writing a credit card cancellation letter might seem like a small step, but it's a powerful move toward taking control of your finances. It provides a documented record of your decision, protects you from potential issues, and offers peace of mind. While digital options exist, the tangible nature of a letter strengthens your position and ensures a clean break from unwanted plastic. Don't underestimate the power of putting pen to paper (or fingers to keyboard) when it comes to managing your financial well-being. Take charge of your credit, and say goodbye to unwanted cards with a well-crafted cancellation letter. Your wallet (and your future self) will thank you. Take the time to craft a clear and concise letter, send it via certified mail, and follow up to ensure a smooth and hassle-free cancellation process. This proactive approach can save you headaches and potentially protect your credit score. So, take control, write that letter, and liberate yourself from the burden of unwanted credit cards!

Unlocking the charm of behr cottage white paint

Maximize your ea fc 24 coins with smart player transfers

Saddlebrooke tucson az rentals your desert oasis awaits