Navigating Healthcare Costs with AARP Supplemental Insurance

Facing the rising costs of healthcare can be a significant concern, especially as we age. For many seniors, Medicare provides crucial coverage, but it doesn't cover everything. This is where AARP supplemental health insurance, offered through UnitedHealthcare, comes into play. These plans, also known as Medigap policies, are designed to help fill the gaps in Original Medicare coverage, potentially saving you significant money on out-of-pocket expenses.

Understanding the complexities of healthcare coverage can feel overwhelming. However, taking the time to research and compare supplemental insurance options can bring peace of mind. AARP supplemental plans offer various coverage levels, allowing individuals to choose a plan that aligns with their budget and healthcare needs. By exploring these options, seniors can potentially reduce financial stress associated with unexpected medical bills.

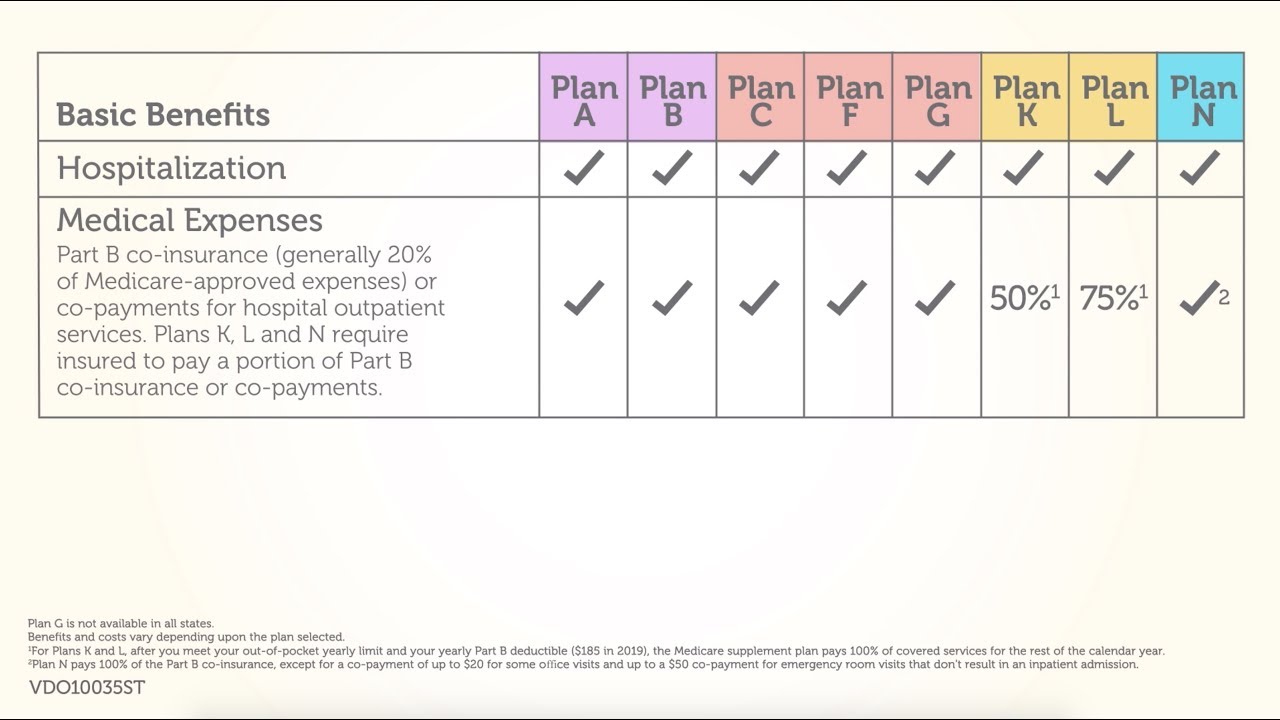

AARP, a trusted organization advocating for seniors' interests, does not directly offer insurance. They endorse plans offered by UnitedHealthcare, designed to supplement Original Medicare (Parts A and B). These plans are standardized across states, offering a predictable range of benefits. Each plan is labeled with a letter (e.g., Plan G, Plan N), which indicates the specific coverage it provides. This standardization makes it easier for consumers to compare plans and choose the one that best meets their needs.

The history of Medigap plans, like those offered through AARP/UnitedHealthcare, stems from the recognition that Original Medicare doesn't cover all healthcare costs. Over time, these plans have evolved to offer more comprehensive coverage options. It’s important to understand that AARP supplemental plans are secondary coverage, meaning they pay after Medicare has paid its share. This helps to reduce or eliminate cost-sharing expenses, such as copayments, coinsurance, and deductibles.

Several key issues often arise regarding supplemental insurance. One is the cost of premiums, which can vary depending on the plan and location. Another is the importance of comparing plans to find the right balance of coverage and affordability. Also, pre-existing conditions can play a role in eligibility and coverage options. It's crucial to carefully review plan details and consider your individual health situation when making a decision.

AARP/UnitedHealthcare offers a range of plans (Plan A, Plan G, Plan N, etc.), each providing specific benefits. Plan G, for example, generally covers most Medicare cost-sharing, excluding the Part B deductible. Plan N, on the other hand, covers most costs but may require copays for doctor visits and emergency room visits. Considering your typical healthcare usage can help determine which plan best suits your needs.

Benefits of AARP plans include predictable healthcare costs, greater choice of doctors and hospitals within the Medicare network, and potential travel coverage. Having supplemental coverage can offer financial security, knowing that many out-of-pocket expenses will be covered. This can be especially valuable during unexpected illnesses or hospital stays.

Advantages and Disadvantages of AARP Supplemental Health Insurance

| Advantages | Disadvantages |

|---|---|

| Predictable costs | Monthly premiums |

| Freedom to choose doctors and hospitals within the Medicare network | May not cover all out-of-pocket expenses |

| Peace of mind and financial security | Can be complex to choose the right plan |

Frequently Asked Questions:

1. What is the difference between Medicare Advantage and AARP supplemental insurance? Supplemental plans work alongside Original Medicare, while Medicare Advantage replaces it.

2. How do I enroll in an AARP/UnitedHealthcare plan? You can enroll through the UnitedHealthcare website or by phone.

3. Are there age restrictions for AARP supplemental plans? You are typically eligible during your Medigap Open Enrollment Period.

4. Can I switch plans later? You may be able to switch plans, but guaranteed issue rights may not apply outside of specific enrollment periods.

5. What does it mean that AARP endorses these plans? AARP endorses the plans but does not directly provide the insurance; UnitedHealthcare does.

6. Can I use my AARP supplemental plan anywhere in the U.S.? Most plans offer coverage nationwide for services covered by Medicare.

7. How much do premiums cost? Premiums vary by plan, location, and individual factors.

8. What is a Medigap Open Enrollment Period? This is a six-month period after you turn 65 and enroll in Medicare Part B during which you have guaranteed issue rights for Medigap policies.

Tips for Choosing a Plan: Consider your current health needs, expected future needs, and budget. Compare plans carefully and consult with a licensed insurance agent.

In conclusion, navigating the world of supplemental healthcare can seem daunting, but taking the time to understand your options is essential. AARP supplemental health insurance, offered through UnitedHealthcare, provides an avenue to manage out-of-pocket healthcare costs associated with Original Medicare. By exploring the different plan options, comparing benefits, and considering your individual needs, you can make an informed decision. Securing supplemental coverage offers peace of mind, knowing that you have a safety net in place to help manage healthcare expenses, now and in the future. It’s a crucial step in planning for a financially secure retirement. Don't hesitate to reach out to UnitedHealthcare for personalized guidance and to choose the best plan for your needs.

Mastering invitation letter appointments a comprehensive guide

Spooky stylish ultrawide dual monitor ghost wallpaper

The rise of young black male actors reshaping hollywood