Navigating Humana Medicare Prescription Drug Plans

Are you feeling overwhelmed by the complexities of Medicare prescription drug coverage? Choosing the right plan can feel like navigating a maze, especially with the numerous options available. This article aims to demystify Humana Medicare prescription drug plans, providing a comprehensive guide to help you make informed decisions about your healthcare.

Medicare Part D, the prescription drug benefit, is a crucial component of healthcare for many seniors and individuals with disabilities. Humana, a leading provider of Medicare plans, offers a variety of Part D options. Understanding the nuances of these plans, including their formularies (lists of covered drugs), premiums, deductibles, and cost-sharing structures, is essential for managing your medication expenses and ensuring access to the prescriptions you need.

Humana's presence in the Medicare Part D landscape reflects a broader shift towards private insurance within the Medicare program. Originally, Medicare provided primarily fee-for-service coverage. Over time, Medicare Advantage and Part D plans offered by private insurers like Humana have become increasingly popular, providing beneficiaries with choices and often incorporating additional benefits beyond traditional Medicare.

The significance of Humana's Medicare prescription drug plan offerings lies in their potential to significantly impact beneficiaries' health and financial well-being. Choosing the wrong plan can lead to unexpected out-of-pocket costs, difficulty accessing necessary medications, and even adverse health outcomes. Conversely, selecting a plan that aligns with your individual medication needs and budget can provide peace of mind and contribute to better health management.

One of the main issues surrounding Humana Medicare Rx plans, like other Part D plans, is the complexity of the system itself. Understanding the various plan tiers, coverage phases (deductible, initial coverage, coverage gap, catastrophic coverage), and formulary changes can be challenging. Furthermore, comparing plans from different insurers and navigating the enrollment process can require significant time and effort. Let's explore how to effectively navigate these complexities.

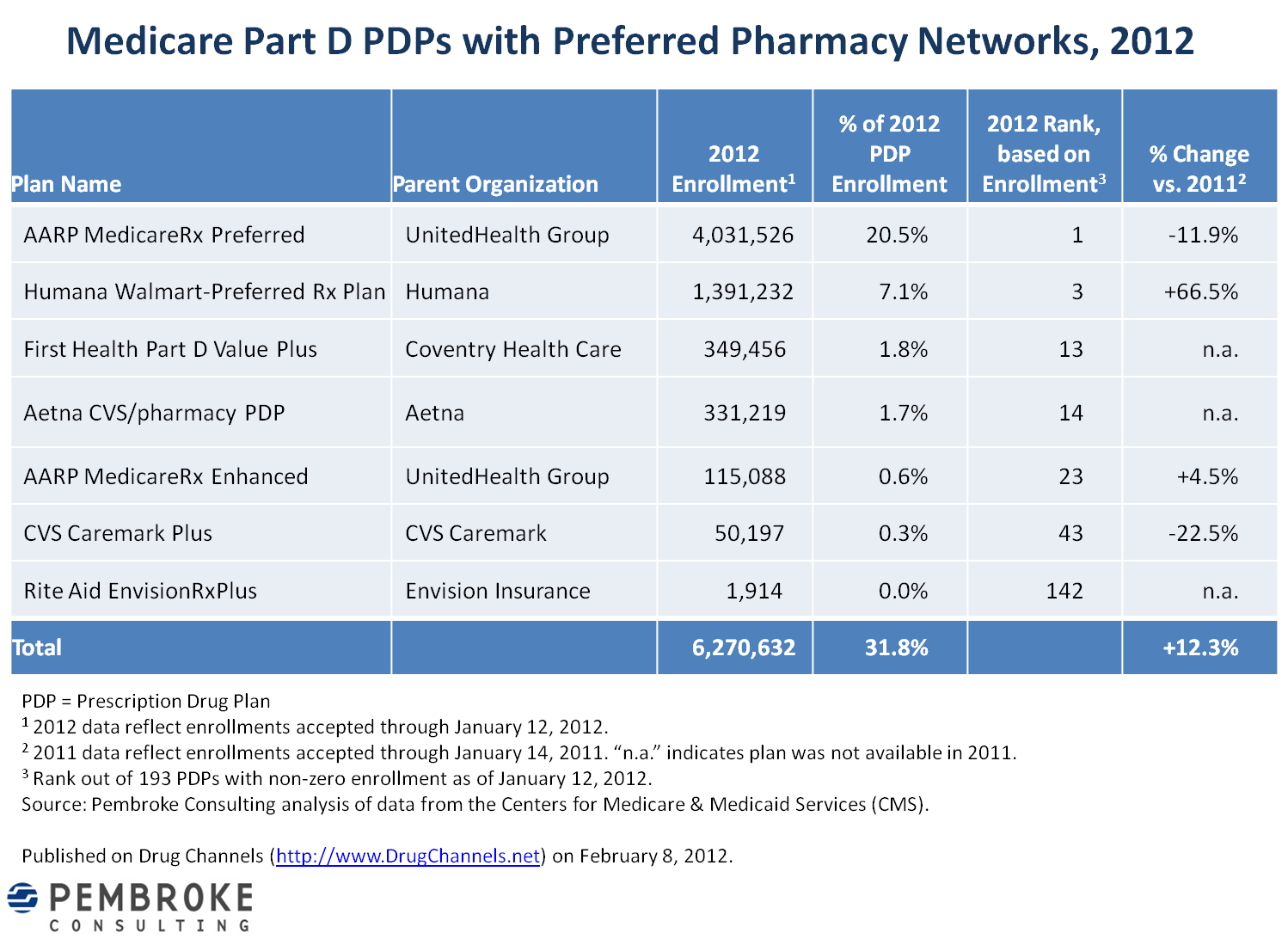

Humana typically offers several different Medicare Part D plans, each with varying premiums, deductibles, and co-pays. Some plans may offer preferred pharmacy networks where you can fill your prescriptions at a lower cost. It's important to carefully review the plan's formulary to ensure that your specific medications are covered and to understand the tier placement of your drugs, as this impacts your cost-sharing.

One potential benefit of a Humana Medicare Part D plan might be the inclusion of additional benefits, such as coverage for certain over-the-counter medications or discounts on wellness programs. Another advantage could be the integration with a Humana Medicare Advantage plan, streamlining your healthcare coverage under a single provider.

Before enrolling in a Humana Medicare Part D plan, it's advisable to create a list of your current medications, including dosages and frequency. This information will be crucial for comparing plans and ensuring that your prescriptions are covered. Use online tools like the Medicare Plan Finder to compare plans in your area and estimate your potential out-of-pocket costs.

Advantages and Disadvantages of Humana Medicare Rx Plans

| Advantages | Disadvantages |

|---|---|

| Variety of plan options | Plan complexity can be confusing |

| Potential for additional benefits | Formulary changes can disrupt medication access |

| Integration with Medicare Advantage plans | Cost-sharing can vary significantly between plans |

Frequently Asked Questions:

Q: How do I enroll in a Humana Medicare Part D plan? A: You can enroll online through the Medicare Plan Finder, by phone, or through a licensed insurance broker.

Q: When can I enroll in a Part D plan? A: Typically during the Annual Enrollment Period (October 15th - December 7th) or during a Special Enrollment Period if you qualify.

Navigating the world of Medicare prescription drug plans can be challenging. However, by carefully considering your individual needs, researching plan options, and utilizing available resources, you can select a Humana Medicare Part D plan that provides the coverage you need at a price you can afford. Remember to review your plan annually during the Annual Enrollment Period to ensure it continues to meet your needs. This proactive approach empowers you to manage your healthcare effectively and maintain your well-being. Talk to your doctor or a licensed insurance agent if you have specific questions about Humana's plan offerings.

Unlocking the brass navigating the trombone market

Deconstructing the rogue dd 5e wikidot deep dive

The power of solid dark green backgrounds