Unlock Your Finances: The Power of Free Accounting Sheets

Are you tired of drowning in receipts and struggling to track your spending? Whether you're managing personal finances or running a small business, keeping tabs on your money is crucial. Imagine a simple, accessible tool that could revolutionize your financial organization – that's the power of a free accounting sheet (hoja de contabilidad gratis).

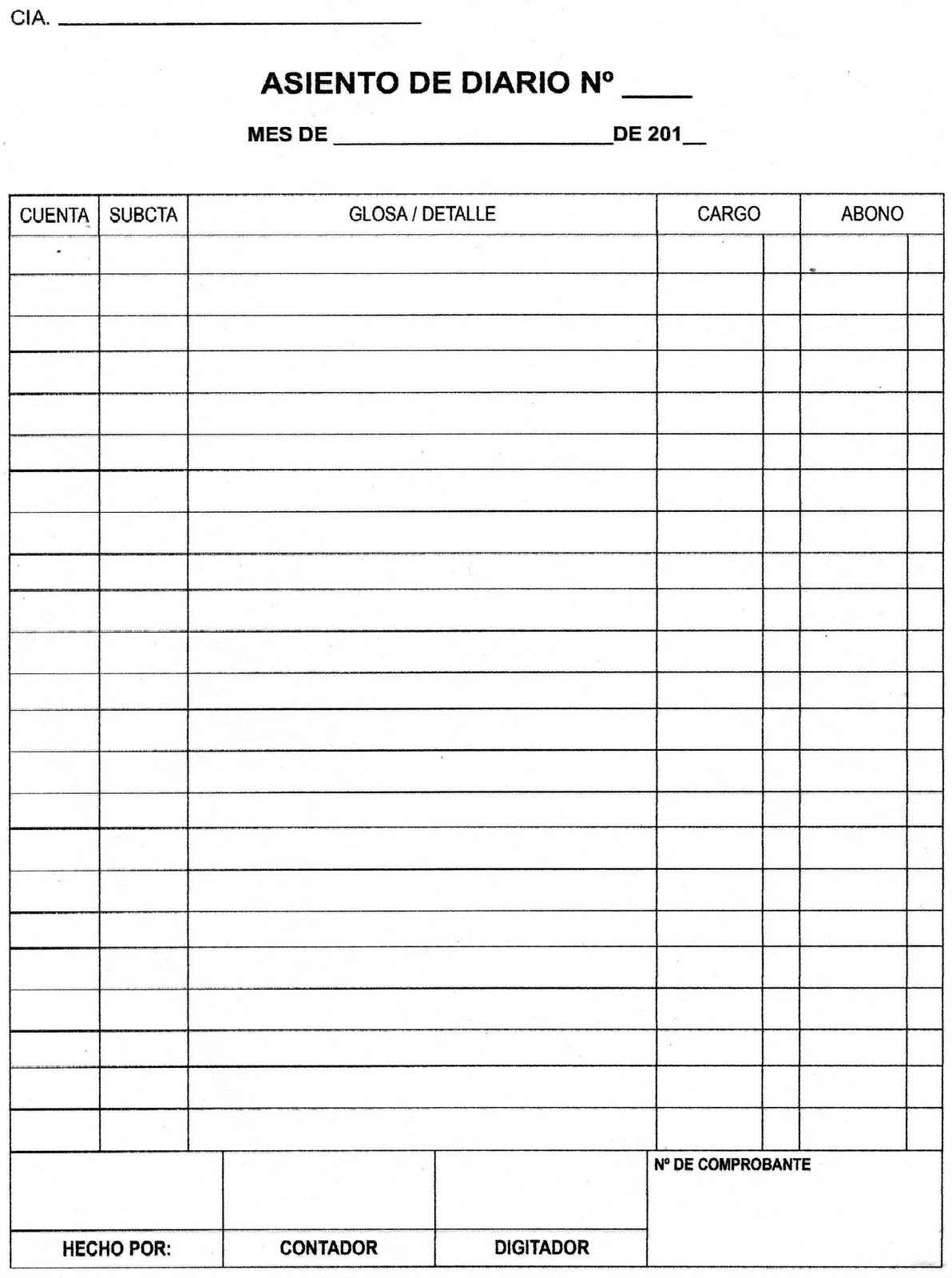

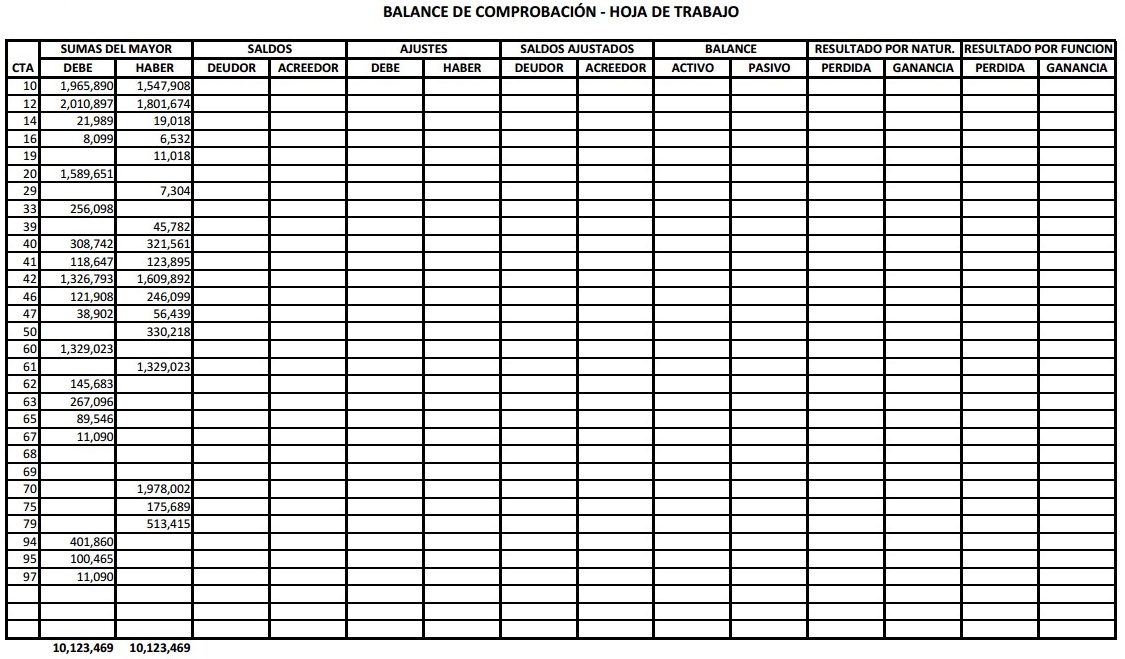

A free accounting sheet, or hoja de contabilidad gratis in Spanish, is essentially a template, often a spreadsheet, designed to record financial transactions. It provides a structured way to track income, expenses, and ultimately, your financial health. From basic personal budgeting to more complex business accounting, these free resources can be a game-changer.

The beauty of free accounting sheets lies in their accessibility. No need for expensive software or complicated setups – you can find numerous templates online that can be downloaded and customized to your needs. This makes them a perfect solution for individuals, freelancers, and small businesses looking for a straightforward and cost-effective way to manage their finances.

But where did these invaluable tools originate? The concept of accounting sheets dates back centuries, evolving alongside the development of bookkeeping and accounting practices. Initially handwritten in ledgers, they transitioned to digital formats with the advent of spreadsheets and accounting software. Today, free accounting sheets are readily available online, democratizing access to efficient financial management.

The importance of using a free accounting sheet cannot be overstated. It empowers you to take control of your finances, providing a clear picture of your income and expenses. This insight can help you identify areas where you can save money, track your progress towards financial goals, and make informed business decisions.

A basic free accounting sheet will typically include columns for date, description, income, and expenses. More advanced versions might incorporate categories for different types of income and expenses, allowing for more detailed tracking and analysis. For example, a small business owner might categorize expenses into areas like marketing, inventory, and salaries.

One of the primary benefits of using a free accounting sheet is improved financial awareness. By meticulously recording transactions, you gain a deeper understanding of where your money is going. This awareness can be incredibly empowering, leading to more conscious spending habits and better financial decisions.

Another key advantage is simplified budgeting. With a clear overview of your income and expenses, creating and sticking to a budget becomes much easier. You can identify areas where you're overspending and adjust your habits accordingly.

Finally, using a free accounting sheet provides valuable data for tax purposes. Having organized financial records makes tax preparation significantly less stressful and ensures you can accurately claim deductions and avoid penalties.

Advantages and Disadvantages of Free Accounting Sheets

| Advantages | Disadvantages |

|---|---|

| Cost-effective | Limited features compared to paid software |

| Easy to use and customize | Potential for errors if not used carefully |

| Accessible from anywhere with internet access | May not be suitable for complex business accounting |

Best Practices for Implementing Free Accounting Sheets:

1. Choose the right template: Select a template that aligns with your specific needs.

2. Be consistent: Regularly update your sheet with all transactions.

3. Categorize transactions: Use categories to organize and analyze your spending.

4. Review regularly: Analyze your sheet periodically to identify trends and areas for improvement.

5. Back up your data: Regularly save copies of your sheet to prevent data loss.

Frequently Asked Questions:

1. Where can I find free accounting sheets? You can find them on various websites offering free templates.

2. What is the difference between a free accounting sheet and paid software? Paid software typically offers more advanced features, but free sheets are sufficient for basic needs.

3. Can I use a free accounting sheet for my business? Yes, especially for small businesses or freelancers.

4. How often should I update my accounting sheet? Ideally, update it daily or at least weekly.

5. What are some common mistakes to avoid? Inconsistent updating, incorrect categorization, and lack of backups.

6. Are there any mobile apps for accounting sheets? Yes, several apps offer similar functionality.

7. How can I customize a free accounting sheet? Most spreadsheet templates can be easily customized.

8. Can I use a free accounting sheet for tax purposes? Yes, organized records from your sheet can be used for tax preparation.

Tips and Tricks:

Use cloud-based spreadsheets for easy access and collaboration.

Automate data entry where possible.

Set up budget alerts to avoid overspending.

In conclusion, leveraging the power of a free accounting sheet, or hoja de contabilidad gratis, can significantly impact your financial well-being. Whether you're aiming to gain control of your personal spending or streamline your small business finances, these readily available resources provide a straightforward and cost-effective solution. By implementing best practices and diligently tracking your transactions, you can unlock invaluable insights into your financial health. Start using a free accounting sheet today and embark on your journey towards greater financial awareness and control. Don't wait, take control of your finances now! Explore the various free templates available online and find the perfect one that suits your individual or business needs. Remember, financial success starts with organized finances.

Exploring sherwin williams pink paint a colorful journey

Embrace tranquility exploring sherwin williams beach glass

Raintree green benjamin moore the secret sauce to a stylish home