Unlocking Financial Clarity: The Power of Accounting Worksheets

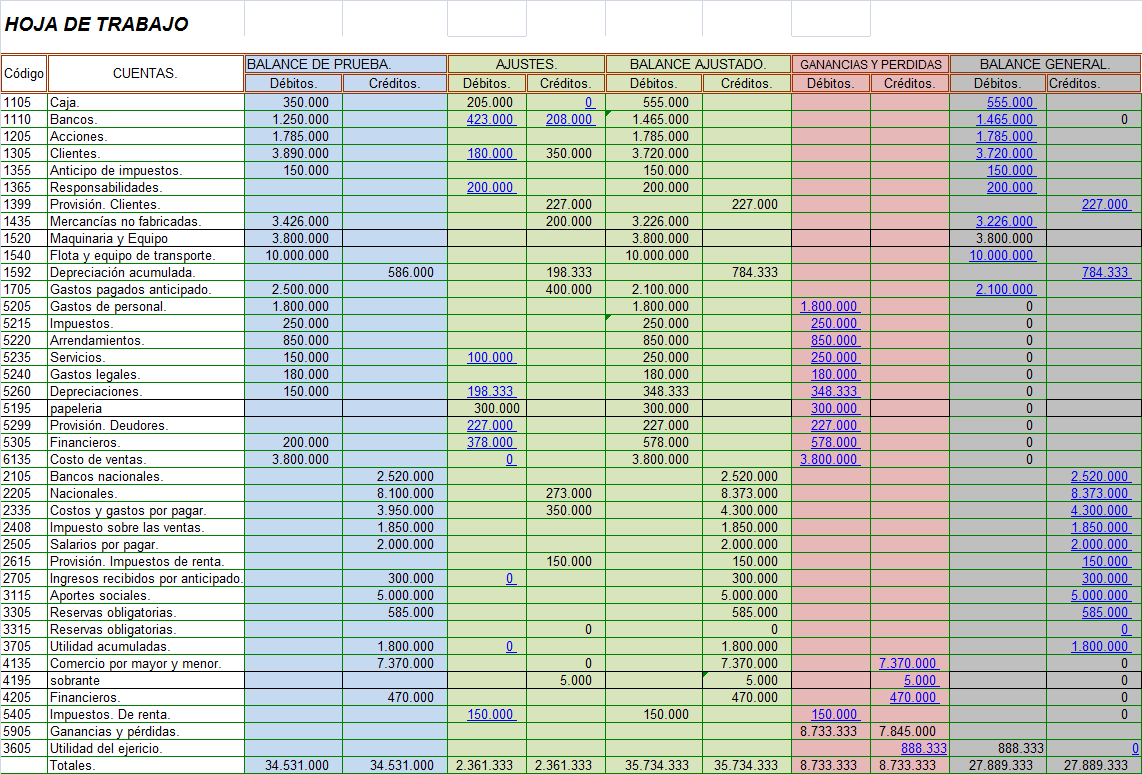

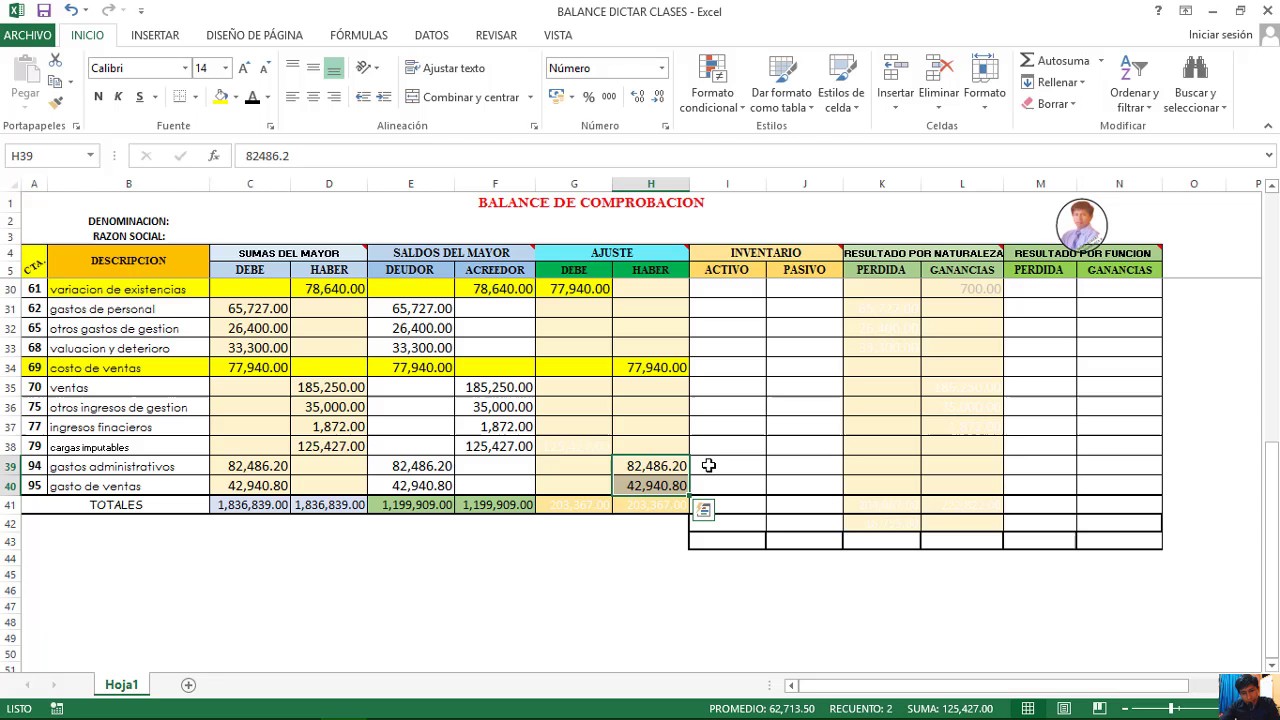

In the fast-paced world of finance, having a clear and organized understanding of your financial data is paramount. But how do you navigate the complex web of transactions, balances, and adjustments? Enter the accounting worksheet, a powerful tool that can transform how you manage your finances. What is an accounting worksheet (or, as it's known in Spanish, a hoja de trabajo contable)? It's more than just a spreadsheet; it's a structured document that acts as a bridge between your trial balance and financial statements.

Think of an accounting worksheet as a behind-the-scenes organizer, a crucial intermediary step in the accounting cycle. It allows you to systematically analyze, adjust, and prepare financial data before finalizing your income statement, balance sheet, and statement of cash flows. This pre-finalization stage is invaluable for catching errors and ensuring accuracy before presenting your financial position to the world. Whether you're a small business owner, a freelancer, or managing the finances of a large corporation, understanding and utilizing an accounting worksheet (hoja de trabajo contable) can significantly enhance your financial control.

The historical origins of accounting worksheets are intertwined with the development of double-entry bookkeeping. As businesses grew in complexity, the need for a systematic way to organize and adjust accounts before finalizing financial statements became apparent. While the precise origin is difficult to pinpoint, the fundamental principles of accounting worksheets have remained consistent for centuries: organizing financial data, facilitating adjustments, and streamlining the preparation of financial reports. This consistent structure, reminiscent of a table or grid, makes a hoja de trabajo contable an invaluable tool for accuracy and analysis.

The importance of an accounting worksheet (hoja de trabajo contable) lies in its ability to simplify the complex process of preparing financial statements. It provides a structured format for making adjusting entries, ensuring that revenues and expenses are properly matched and that the accounting equation (Assets = Liabilities + Equity) remains balanced. Without a worksheet, the process of preparing financial statements would be significantly more cumbersome and prone to errors. Imagine trying to assemble a complex puzzle without first sorting the pieces – a worksheet is that essential sorting mechanism for your financial data.

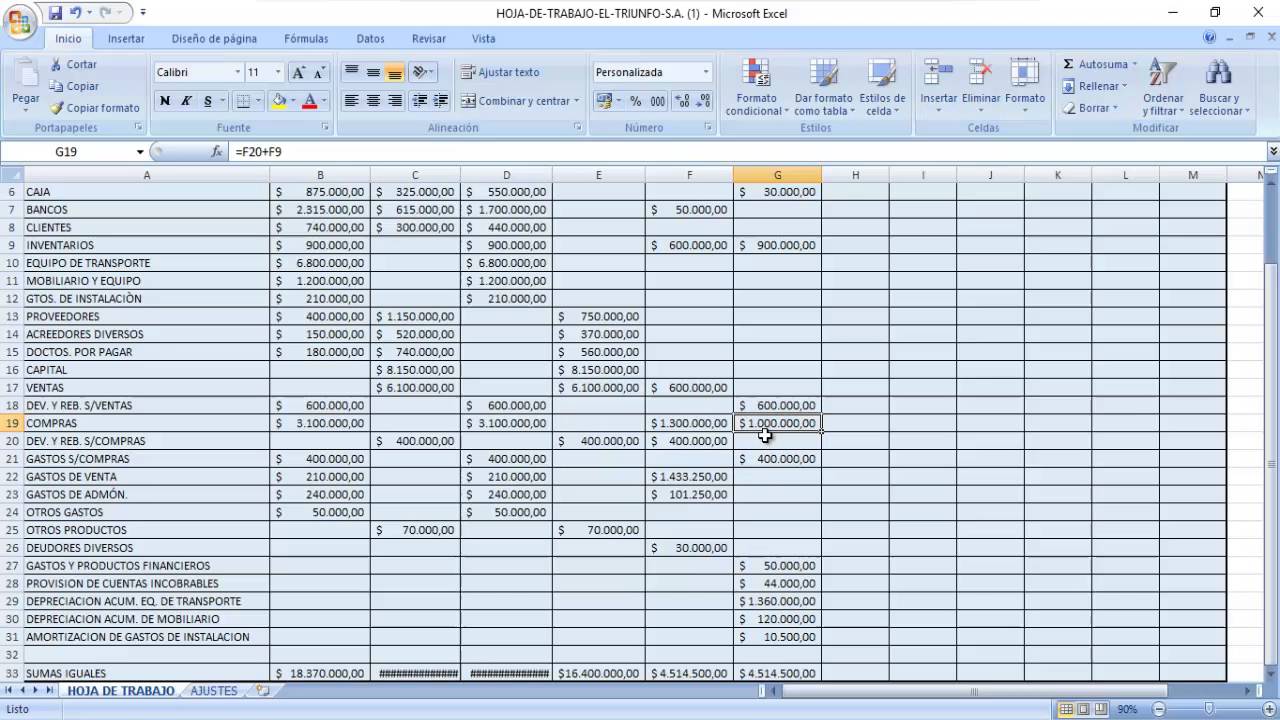

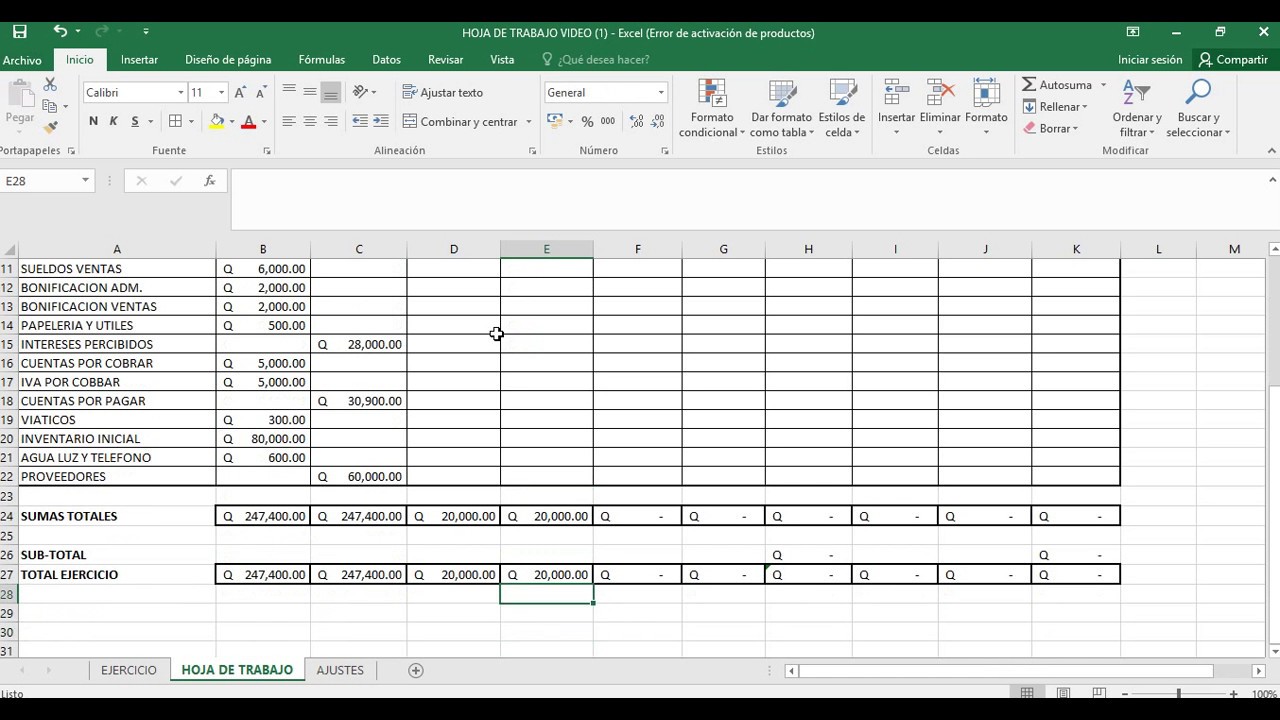

One of the key issues related to using accounting worksheets effectively is understanding the different types of adjustments that can be made. These adjustments can range from accruals (recording revenues earned but not yet received) to deferrals (recognizing expenses paid in advance) and depreciation (allocating the cost of an asset over its useful life). Mastering these adjustments is crucial for accurately reflecting your financial performance and position on your final statements. Think of these adjustments as fine-tuning your financial picture, ensuring that it reflects the true economic reality of your business operations.

A simple example of using a hoja de trabajo contable is adjusting for prepaid insurance. Suppose you paid $1,200 for a one-year insurance policy. At the end of each month, you would use the worksheet to adjust the prepaid insurance account by $100 (1,200 / 12) and recognize $100 of insurance expense. This ensures that your financial statements accurately reflect the insurance expense incurred during that period. This meticulous tracking and adjustment are key functions of the hoja de trabajo contable.

Advantages and Disadvantages of Accounting Worksheets

| Advantages | Disadvantages |

|---|---|

| Improved Accuracy | Can be Time-Consuming |

| Easier Identification of Errors | Potential for Errors in the Worksheet Itself |

| Simplified Financial Statement Preparation | Not a Substitute for Formal Accounting Systems |

A typical accounting worksheet will include columns for the trial balance, adjustments, adjusted trial balance, income statement, and balance sheet. It allows you to see the impact of adjusting entries on your financial statements before finalizing them. By meticulously documenting each adjustment within the hoja de trabajo contable, you ensure a clear audit trail and a better understanding of your financial performance.

One best practice is to maintain clear and concise labels for each account and adjustment. Another is to regularly reconcile your worksheet with your underlying accounting records. This consistent and organized approach to using your hoja de trabajo contable is essential for accurate financial reporting.

In conclusion, the accounting worksheet, or hoja de trabajo contable, is an indispensable tool for anyone seeking to gain control and clarity over their finances. It provides a structured framework for organizing financial data, making necessary adjustments, and streamlining the preparation of financial statements. By mastering the use of an accounting worksheet, you empower yourself to make informed financial decisions and navigate the complex world of finance with confidence. While it requires diligence and attention to detail, the benefits of using a hoja de trabajo contable far outweigh the effort involved. Start using an accounting worksheet today, and unlock the potential for greater financial clarity and control.

Revitalize your home with aluminum siding paint

The allure of white exploring behrs finest interior paints

Power up your doorbell mastering transformer installation with youtube